In the event you think a transfer or withdrawal shown on your statement is incorrect, or if you believe an unauthorized transfer or withdrawal has taken place-including those made through your ATM/debit card, code, or other means-contact us immediately.Please review your statements and verify that all the transactions shown were authorized by you. If you don't receive your statements by mail, we make an electronic version available in Online Banking. Capital One sends monthly statements to your address on record unless you elect to go paperless.Protections Provided for Electronic Funds Transfers Online Banking Bill Payment: Online payments include payments made from a Capital One account (including scheduled payments via our online bill pay service), any payment to certain Capital One accounts and payments in the form of funds transfers to eligible loan or line of credit accounts.Capital One sets limitations on daily and monthly transactions for your protection.

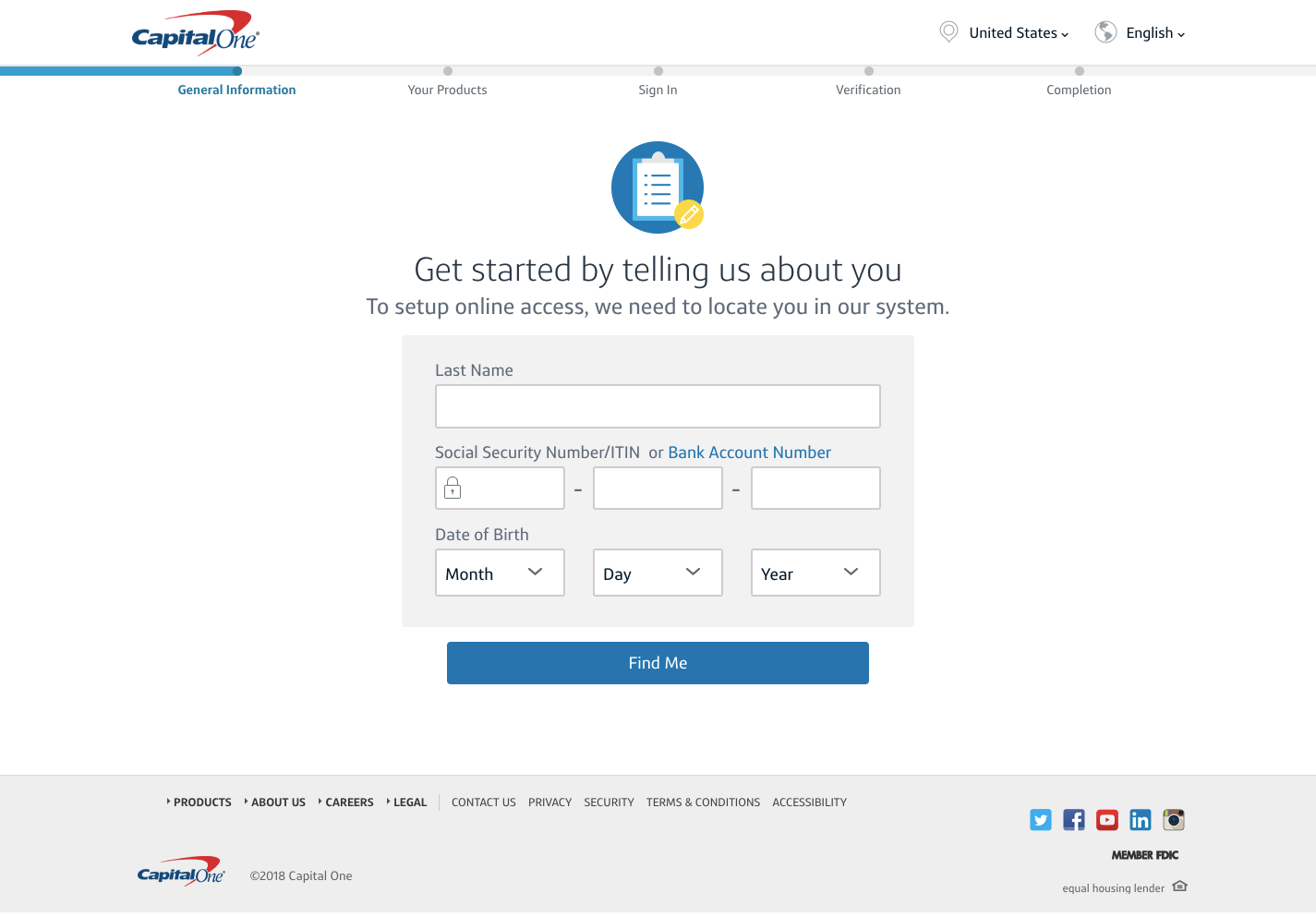

When you enroll, you will be provided terms and conditions that apply to electronic transfers using our online banking services.

When using these services, we ask that you monitor your account and alert us of any unauthorized transactions. Such services include, ATM/debit cards, electronic check conversion, phone transfers, online bill payment and online banking external funds transfer. We’ll never ask you over the phone to provide your online banking password.Ĭapital One offers various ways to move money electronically for the purpose of paying bills, making purchases and managing your accounts.If you ever suspect the party contacting you is not Capital One, please tell the caller that you would prefer to contact Capital One directly and call back using the contact numbers on our site or on the back of your card.We may contact you via text to confirm an attempted charge (to prevent fraud), but we will never ask you to confirm or verify your personal information in an unsolicited text message.

#CAPITAL ONE SIGN IN FOR PAYMENT VERIFICATION#

Fraud agents will require verification of your identity prior to discussing your account. If you’re ever in doubt about a communication instance, forward any suspicious emails to Our Fraud department may contact you if we detect unexpected activity on your account. We may contact you by email with offers or to provide account information.Our agents will not ask you over the phone to provide your online banking password.Our agents, whether over the phone or in our branches and cafes, may ask you to verify information we have on file or ask other questions to confirm your identity.When you initiate contact with Capital One, we’ll verify your identity before sharing account information or performing transactions on your behalf.Here's what to expect when you contact us or we contact you. Our communication practices can help you keep your sensitive information secure.

0 kommentar(er)

0 kommentar(er)